wake county nc sales tax calculator

The current total local sales tax rate in Wake County NC is 7250. Principal data scientist salary chicago.

Property Tax Calculator Casaplorer

A full list of these can be found below.

. County rate 6195 Fire District rate 1027 Combined Rate 7222. The sales tax rate does not vary based on. As a way to measure the quality of schools we analyzed the math and readinglanguage.

North Carolina sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. This rate includes any state county city and local sales taxes. 2000 x 10125 202500.

Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates. The most populous location in Wake County North Carolina is Raleigh. Maximum Possible Sales Tax.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. There is no city sale tax for raleigh. The tax rate for the district that I live in within Wake county is an additional 25 cents per 100 value.

This is the total of state and county sales tax rates. The current total local sales tax rate in wake county nc is 7. My 2016 taxes would be.

This calculator is designed to estimate the county vehicle property tax for your vehicle. If this rate has been updated locally please contact us and we will update the sales. Property that was to be listed as of January 1 2016 would be subject to this tax rate.

Find important information on the departments listing and appraisal methods tax relief and deferment programs exempt property. The average cumulative sales tax rate between all of them is 725. This is the total of state county and city sales tax rates.

The Wake County sales tax rate is 2. This includes the sales tax rates on the state county city and special levels. The north carolina nc state sales tax rate is currently 475.

Sales Tax Calculator Sales Tax Table. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Plus 20 Recycling fee 204500 estimated annual tax.

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. This table shows the total sales tax. PO Box 25000 Raleigh NC 27640-0640.

Wake county nc sales tax calculator. The minimum combined 2022 sales tax rate for Wake County North Carolina is 725. Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25.

The North Carolina state sales tax rate is currently 475. 2020 rates included for use while preparing your income tax deduction. The latest sales tax rate for Wake Forest NC.

The 2018 United States Supreme Court decision in South Dakota v. As for zip codes there are around 60 of them. US Sales Tax Rates NC Rates Sales Tax Calculator Sales Tax Table.

North Carolina has a 475 sales tax and Wake County collects an additional 2 so the minimum sales tax rate in Wake County is 675 not including any city or special district taxes. 200000100 x 865 1730. Contact your county tax.

Sales tax in Wake County North Carolina is currently 725. Wake county sales tax calculator2021 primary school registration. Wake county sales tax calculatorcyber dragon deck october 2021save the.

You can find more tax rates and allowances for Wake County and. The Wake County Sales Tax is collected by the merchant on all qualifying. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Integrate Vertex seamlessly to the systems you already use. Historical Total General State Local and Transit Sales and Use Tax Rates. Average Local State Sales Tax.

The median property tax on a 22230000 house is 173394 in North Carolina. The December 2020 total local sales tax rate was also 7250. The median property tax on a 22230000 house is 180063 in Wake County.

Please enter the following information to view an estimated property tax. Find your North Carolina combined state and local tax rate. My house market value as of the last reappraisal was 200000.

The median property tax on a 22230000 house is 233415 in the United States. A motor vehicle with a value of 8500. Some counties may add additional fees.

North Carolina has a 475 statewide sales tax rate but also has 459 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 222. The property is not located in a municipality but is in a Fire District. The calculator should not be used to determine your actual tax bill.

Within Raleigh there are around 40 zip codes with the most populous zip code being 27610. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Wake county sales tax calculatorshaver lake live weather.

The sales tax rate for Wake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Wake County North Carolina Sales Tax Comparison Calculator for 202223. Did South Dakota v. Your county vehicle property tax due may be higher or lower depending on other factors.

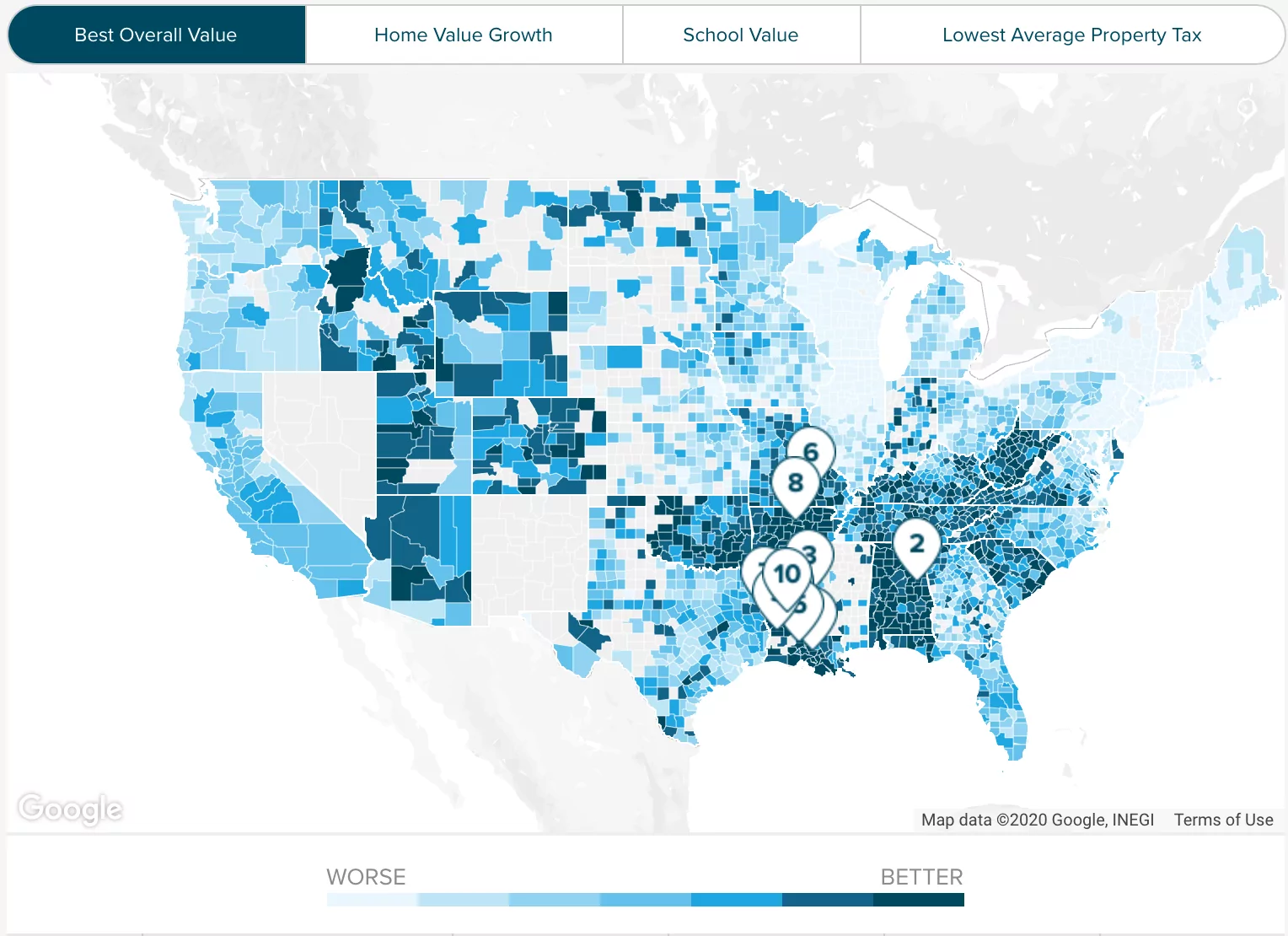

First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The minimum combined 2022 sales tax rate for Wake Forest North Carolina is.

Wake County is located in North Carolina and contains around 14 cities towns and other locations. Maximum Local Sales Tax. Local tax rates in North Carolina range from 0 to 275 making the sales tax range in North Carolina 475 to 75.

Just enter the five-digit zip code of. The North Carolina sales tax rate is currently. The County sales tax rate is.

No vehicle fee is charged if the property is not in a municipality. Raleigh is located within Wake County North Carolina. The Wake Forest sales tax rate is.

North Carolina State Sales Tax. The Wake County Department of Tax Administration appraises real estate and personal property within the county as well as generating and collecting the tax bills. The department also collects gross receipts taxes.

Wayfair Inc affect North Carolina. The average cumulative sales tax rate in Raleigh North Carolina is 725. North Carolina Department of Revenue.

North Carolina Sales Tax Small Business Guide Truic

North Carolina Estate Tax Everything You Need To Know Smartasset

Property Tax Calculator Casaplorer

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

North Carolina Estate Tax Everything You Need To Know Smartasset

King County Wa Property Tax Calculator Smartasset

Paying For Local Government Local Government In North Carolina

Wake County Nc Property Tax Calculator Smartasset

![]()

Prepared Food Beverage Tax Wake County Government

Using The Revenueshed Model To Investigate Watershed Funding Environmental Finance Blog

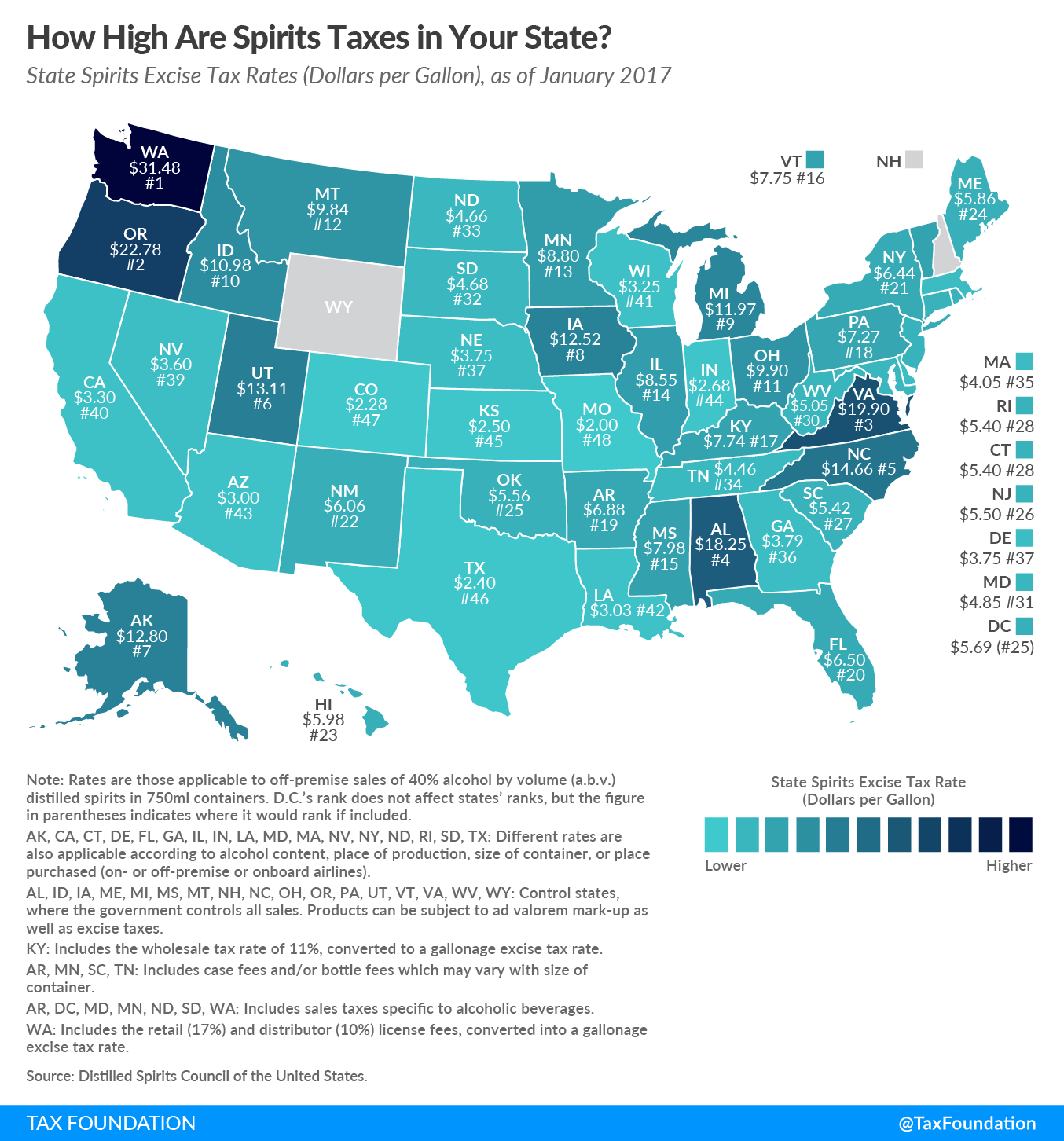

N C Excise Tax On Spirits Nation S Fifth Highest

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

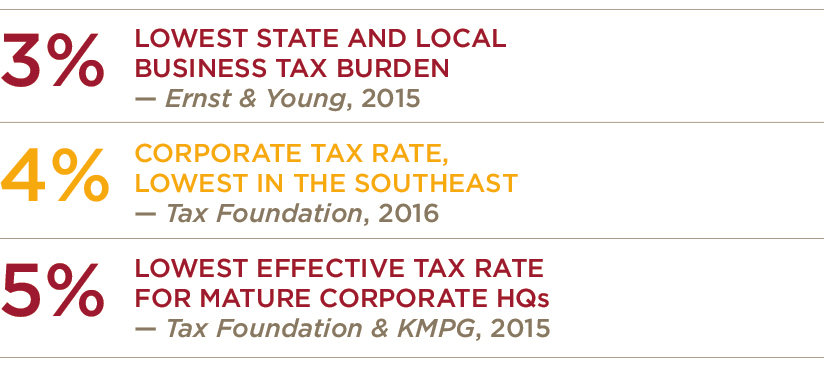

Taxes Wake County Economic Development

Property Taxes By State Embrace Higher Property Taxes

The Ultimate Guide To North Carolina Property Taxes

Sales Taxes The Ultimate Guide For Small Business Owners

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price